What Does Accounting Profit Mean?

A company's total earnings, calculated according to Generally Accepted Accounting Principles (GAAP), and includes the explicit costs of doing business, such as depreciation, interest and taxes.

A company's total earnings, calculated according to Generally Accepted Accounting Principles (GAAP), and includes the explicit costs of doing business, such as depreciation, interest and taxes.

Accounting profits tend to be higher than economic profits as they omit certain implicit costs, such as opportunity costs.

The tax consequences of transactions that occur for accounting purposes during a period should be recognised as income or expense during the current period, regardless of when the tax effects will occur

This requires identifying the current and future tax consequences of items recognised in the balance sheet

Two separate calculations are performed each year:

1.current tax liability

2.movements in deferred tax balances

Calculation of current tax

- Accounting profit/(loss)

- Less Accounting revenue not assessable for tax

- Add Accounting Expense not assessable for tax

- Add/Minus Difference between Accounting revenue and Taxable Income(TI)

- Add/Minus Difference between Accounting Expense and Taxable Deductions(TDs)

Example:

Continued (Example)

This is recorded on General Journal as:

A Temporary Difference is the difference between the tax basis of an asset or liability and its reported (carrying or book) amount in the financial statements that will result in taxable amounts or deductible amounts in future years.

Arise when the period in which revenue and expenses are recognised for accounting is different from the period in which items are recognised for tax

Arise principally due to the accruals vs cash basis of recognising transactions. Differences either result in:

1.The company paying more tax in the future

Taxable temporary differences (TTDs)

Result in deferred tax liabilities (DTLs)

2.The company paying less tax in the future

Deductible temporary differences (DTDs)

Result in deferred tax assets

1.The company paying more tax in the future

Taxable temporary differences (TTDs)

Result in deferred tax liabilities (DTLs)

2.The company paying less tax in the future

Deductible temporary differences (DTDs)

Result in deferred tax assets

1.The company paying more tax in the future

Taxable temporary differences (TTDs)

Result in deferred tax liabilities (DTLs)

2.The company paying less tax in the future

Deductible temporary differences (DTDs)

Result in deferred tax assets (DTAs)

Certain temporary difference are excluded from being recognized.

Standard board prohibits temporary differences from being recognized in relation to:

- Goodwill

- The initial recognition of assets and liabilities that do not arise from a business combination.

Deferred tax liabilities

Deferred tax liabilities must be recognised in full

Deferred tax assets

Deferred tax assets relating to temporary differences and tax losses are recognised only if:

- there are sufficient taxable temporary differences for the entity to use against the deductible temporary differences; OR

- if it is probable that the entity will have sufficient future taxable profit (against which the tax benefit can be offset).

Calculation of deferred tax

The existence of temporary differences results in the carrying amounts of an entity’s assets and liabilities being different from the amounts that would arise if a balance sheet was prepared for tax authorities

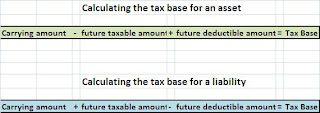

Carrying Amount (CA)

asset and liability balances (net of accumulated depreciation, allowances etc) based on accounting balance sheet.Tax Base(TB)

asset and liability balances that would appear in a “tax balance sheet"Temporary differences are calculated as CA – TB = TTD/(DTD)

Calculating the tax base - examples

Notes to worksheet:

- Prepayments- deductible when paid for tax purposes- therefore no balance would appear as an asset in the “tax” balance sheet.

- Interest receivable- assessable when received- therefore no balance would appear as a receivable asset in the “tax” balance sheet.

- Plant- WDV for tax purposes = $10,000 - $6,500 = $3,500.

- Trade receivables- bad debts not deductible for tax until physically written off- therefore the gross trade receivables amount would appear in the “tax” balance sheet.

- Trade payables- no differences in the treatment of trade payables for tax and accounting purposes- therefore CA = TB.

- Annual leave liability - deductible when paid for tax purposes- therefore no balance would appear as a liability in the “tax” balance sheet

Deferred tax assets and liabilities

The tax rate % is that which is expected to apply when the asset will be realised or the liability settled.

This is recorded as:

The balances in the deferred tax asset and liability accounts are the carried forward closing balances from the prior year

Accumulated depreciation of plant for tax purposes is $360

Required:

Complete the deferred tax worksheet on the following page and prepare the journal to record deferred tax movements for the 30 June 2008 year.

Notes to worksheet:

- Items where the CA = TB have been omitted from worksheet (eg cash, payables, loan)

- AASB 112 does not permit the recognition of a DTL relating to goodwill. The TTD arising is referred to as an “excluded” temporary difference

- Negative figures in the adjustment section would denote decreases in the DTA/DTL balances during the year.

Offsetting tax assets and liabilities

Both current and deferred tax assets and liabilities are to be offset against each other and a net figure shown in the balance sheet position for:

- Current tax

- Deferred tax

Change in tax rates

When a new tax rate is enacted, that new rate should be applied:

- when calculating current tax liability

- when calculating adjustments to deferred tax accounts

- to carried forward deferred tax balances from previous years

Tax Losses

The tax act allows losses to be carried forward and used as a deduction against future taxable income

Tax losses provide future deductions and (subject to recognition criteria) create deferred tax assets

Exempt income cannot contribute to carry forward losses

If prima facie tax loss is $(10 000) but there is exempt income of $2 000 the allowable carry forward loss would be $(8000)

Recoupment occurs as soon as the company earns a taxable income

Tax loss recouped is recorded in the determination of taxable income and a journal entry raised to reverse the DTA

If a prior year’s loss carried forward is being recouped and there is exempt income in the year of recoupment, the exempt income must first be offset against the loss

Disclosure

Tax assets & liabilities must be classified as current or non-current on the face of the statement of financial position

Current and deferred tax assets and liabilities can be offset in most cases

Tax expense on the statement of comprehensive income

Payment of income tax

Company income tax is paid under the PAYG (pay as you go) system in quarterly instalments

Companies must lodge quarterly business activity statements (BAS) and pay tax calculated as:

Instalment income x instalment rate (supplied annually by the taxation department)

Current tax liability represents the last quarterly payment and any adjustments necessary to reflect the fact that annual taxable income may differ from the sum of the quarterly returns